Recently, three leading companies in the global laser industry – IPG, nLight and Coherent – have released their latest financial reports for the first quarter of 2025.

The financial reports of the three laser giants show that fiber laser manufacturing giant IPG’s performance is worrisome, with revenue continuing to decline and net profit plummeting 91% year-on-year, exposing its lack of growth in traditional areas such as welding and cutting; while high-power laser maker nLight’s revenue jumped 16% year-on-year thanks to the explosive growth in defense orders; it’s also worth mentioning that laser and photonics components leader Coherent, on the other hand, benefited from the demand for AI data centers and saw its revenue hit a record high, up 24% year-on-year, and managed to turn a profit.

In fact, in the macroeconomic fluctuations, geopolitical friction and emerging technology iteration of multiple pressures, the first quarter of 2025, these three laser giants because of the differences in strategic focus, to very different development paths: IPG is trapped in the traditional industrial market shrinkage predicament, nLight leveraged the defense orders to break out against the trend, Coherent is riding the wind of AI and data center to achieve profitability reversal.

It is worth noting that, in the regional market, the three companies are presenting “fire and ice”: IPG in the Asian market against the trend of growth of 8%, while Europe and the United States, respectively, 12% and 28% contraction in the market; Coherent relying on the global network of 60 production bases to effectively resolve the impact of tariffs, nLight through the relocation of production base nLight through the relocation of production base strategy to lock the defense orders.

Analysis suggests that behind this divergence in performance is a profound change in the underlying logic of the entire optoelectronics industry: traditional industrial applications are dragged down by the global manufacturing cycle, while emerging areas such as defense and security, artificial intelligence, high-end manufacturing and so on have become growth engines.

IPG

Traditional business stalled.High-end transformation is beginning to see the light of day

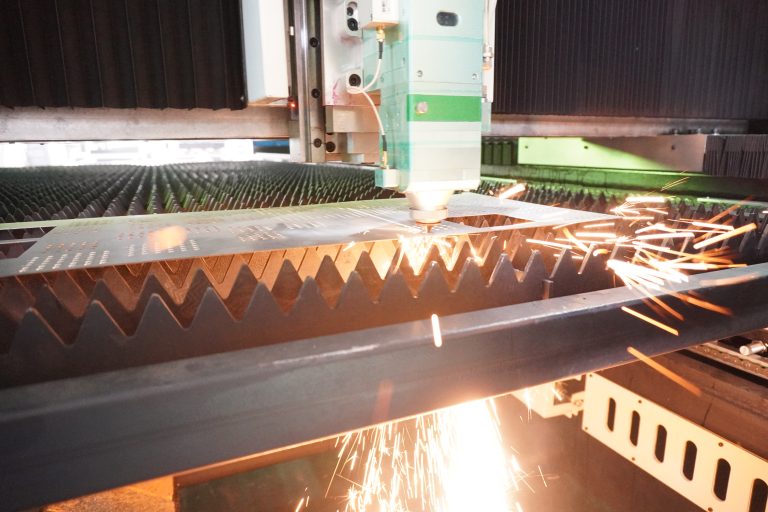

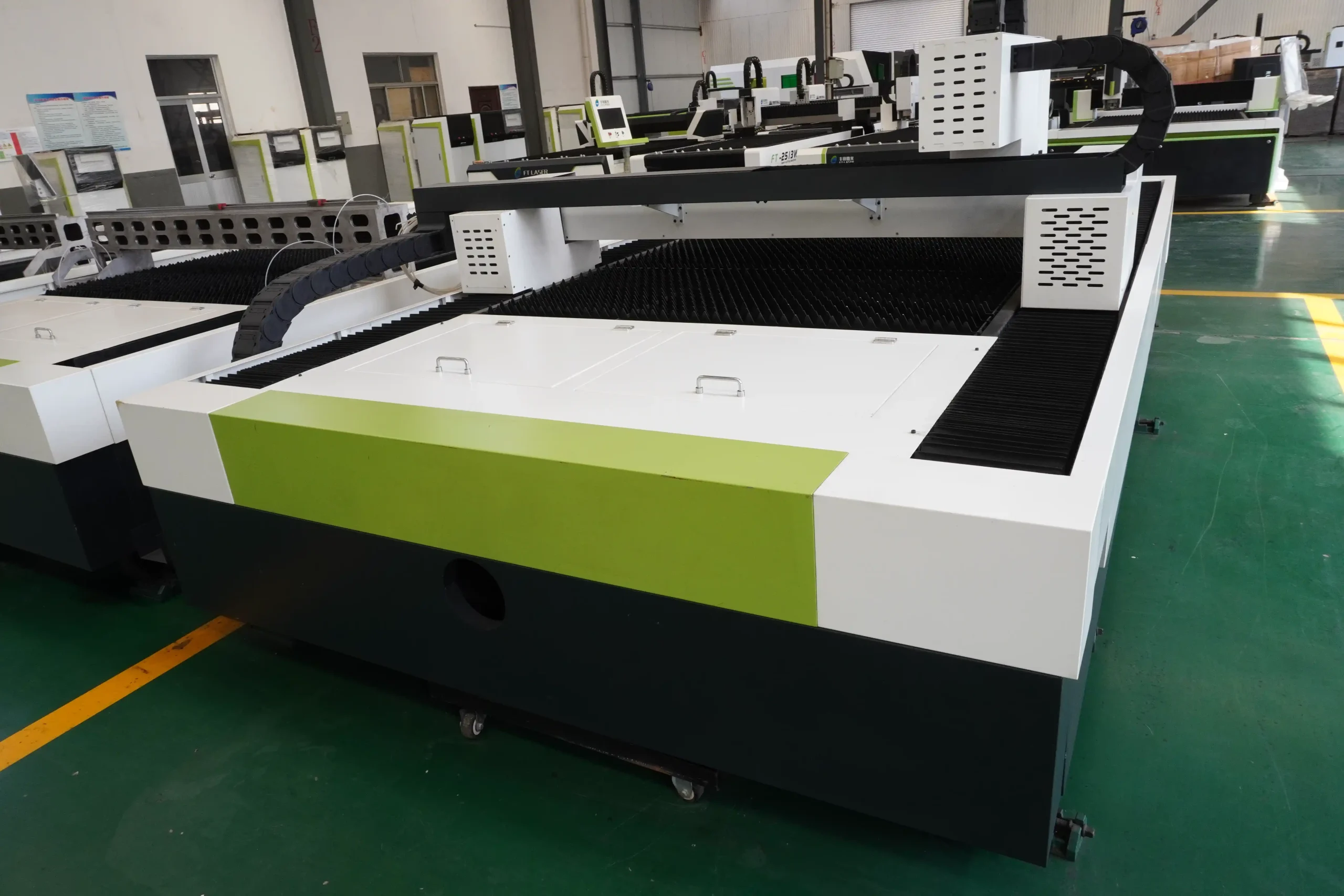

On May 6, global fiber laser manufacturer IPG announced its financial results for the first quarter ended March 31, 2025: revenue fell 10% year-on-year to $228 million, net income plummeted 91% to $1.8 million, and sales in the core materials processing business declined by 14%, with shrinking sales in welding and cutting applications directly dragging down overall performance.

The results continue a 17.7% annual average revenue decline since 2023, reflecting a structural contraction in demand for laser equipment in traditional manufacturing.

However, there are positive signals in the report: medical, precision micromachining and other emerging areas of sales growth of 25% year-on-year, driven by the “other applications” segment of the uptrend; emerging growth in the proportion of products from 48% to 51%, showing that the technology upgrade strategy is beginning to bear fruit.

Regional markets show “East rise and West fall” pattern: the Asian market year-on-year growth of 8%, becoming the only pole of growth, which is closely related to China’s manufacturing industry upgrading and Southeast Asia’s new energy industry chain expansion; and North America, Europe, respectively, fell 12% and 28%, exposing the traditional automotive, heavy industry investment slowdown hidden worries.

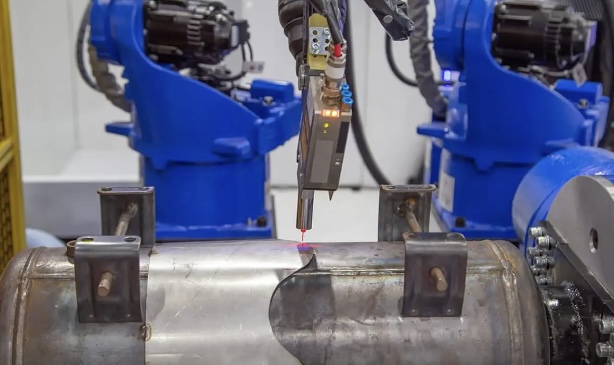

In the face of shrinking traditional business, IPG is accelerating its transition to high-end markets. The management emphasized that medical, precision micromachining and high-end industrial applications have become “new growth engines”. The company has strengthened its laser cleaning technology through the acquisition of Clean-Lasersysteme GmbH in Germany, and launched an automated collaborative robotic welding system in an attempt to open up the market in the field of intelligent manufacturing.

In addition, the tariff policy had a certain impact on the cost in the short term, which led to the deferral of about 15 million dollars of orders, but not canceled. Nonetheless, IPG remains confident about the future and forecasts second quarter 2025 revenue to be between $210 million and $240 million.

“Through continued technological innovation and global capacity optimization, we are confident that we will further expand our competitive advantage in the market.”

Dr. Mark Gitin, IPG’s Chief Executive Officer, said the company has made positive progress in key areas of its strategic transformation, and new growth engines such as medical, precision micromachining and high-end industrial applications have shown strong momentum. Despite the pressure of exchange rate fluctuations, the company exceeded the median expectations for the three core metrics of revenue, adjusted earnings per share and EBITDA, validating the effectiveness of its differentiated product strategy.

nLight

Defense Order Driven.Strategic Migration Addresses Risks

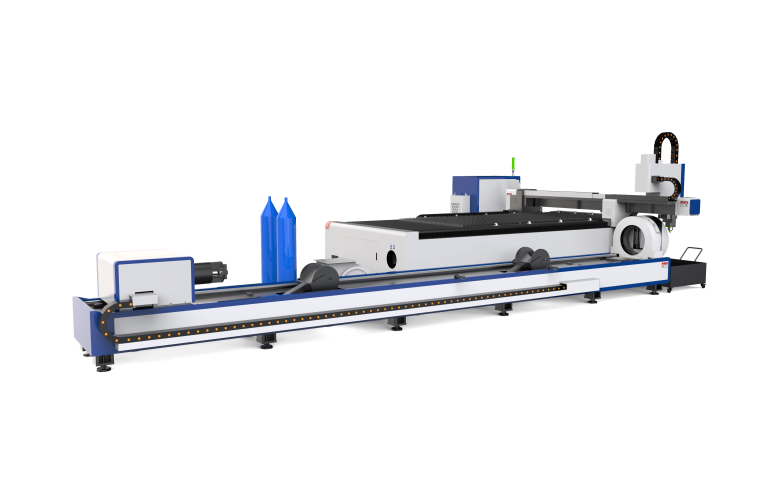

Contrasting with IPG is the strong rebound of nLight. The company, which specializes in high-power lasers, recently announced its first-quarter results: revenue grew 16% to $51.7 million, losses narrowed by more than 40%, and gross margin jumped from 16.8% to 26.7%.

The core engine of growth came from the aerospace and defense market: sales of high-power lasers for directed-energy weapons jumped 50% year-on-year to $32.7 million, accounting for more than 63% of total revenue.

The key to nLigh’s growth lies in its precise bet on the defense track – aerospace and defense revenues surged 50% year-on-year, accounting for 63% of total revenues. The U.S. government-led “Golden Dome” defense program, the Army’s short-range air defense laser program and other arms upgrades have built a moat for nLigh. By shifting production capacity from China to the U.S. and Thailand, nLight has demonstrated strategic flexibility in response to trade frictions, and this dual attribute of “military industry + geo-risk aversion” has won it the favor of capital in a volatile market.

While margins will fluctuate in the short term due to tariffs, management expects the defense business to grow 25% for the full year, well ahead of the industry average.

For the second quarter of 2025, nLight expects revenue to be in the range of $53 million to $59 million, with the mid-range of $56 million consisting of approximately $38 million in revenue from the product business and approximately $18 million in revenue from the advanced R&D business.

Coherent

Earnings Surge Against the Odds.AI frenzy brings “super dividends”

On May 7, Coherent, a globally renowned laser and photonic component manufacturing giant, announced its financial results for the third quarter ended March 31, 2025.

The latest financial results show that Coherent’s revenue for the third quarter of fiscal year 2025 jumped 24% year-on-year to a record high of $1.498 billion, with soaring sales in its networking division, which mainly benefited from the exploding demand for 1.6Tb/s optical modules in AI data centers, which are enjoying the “super dividend” brought by the AI revolution. “.

Continued rapid growth in shipments to AI data centers and telecom applications became the core factor driving the revenue surge, especially the launch of new products related to AI and telecom development such as new 1.6 Tb/s optical transceivers, which brought new growth opportunities for the company, with sales in its networking division reaching $897 million in the three months ended March 31, up 45% year-on-year.

Strong demand for excimer lasers for organic LED (OLED display production annealing applications in the industrial segment, with sales growing steadily to $364 million, up 4% year-on-year, also contributed significantly to the company’s overall earnings growth. However, revenue from sales of silicon carbide electronics involved in its materials division declined slightly, but the company actively optimized its business structure by streamlining its product portfolio and focusing on substrates and epitaxy.

Thanks to sales growth and business streamlining measures, Coherent turned a profit in the latest quarter with a pre-tax profit of $9.9 million, a qualitative leap from a pre-tax loss of $31.9 million in the same period last year.

However, due to increased macroeconomic uncertainty caused by new U.S. import tariffs, Coherent expects sales for the June quarter to be flat compared to the previous quarter, ranging between $1.425 billion and $1.575 billion.